GMPe of pensions for historical transfers

The Plan’s Trustee is currently contacting some former members with service between 17 May 1990 and 5 April 1997 who transferred out their Plan benefits. This is part of a larger exercise to equalise Guaranteed Minimum Pensions (GMPs) throughout the Plan. GMPs exist as a substitute for additional State Pension that would have been built up while the Plan was contracted-out of the State Earnings-Related Pension Scheme. At the time, State Pensions were payable from different ages for men and women, meaning that there are differences in the GMP benefits built up to mirror them.

In 2018, a High Court ruling (also known as the Lloyds case) determined that any gender-based differences relating to benefits between 17 May 1990 and 5 April 1997 should be removed – hence the process of GMP equalisation (GMPe).

In 2020, the High Court ruled that this should also apply to past transfers.

The Trustee has appointed Aon to manage this process. They have been working out whether the original transfer values, adjusted for GMPe, would have resulted in higher payments. We have found that some members’ original transfers would have done, and so they are due a one-off top-up payment.

You can find more information below. You might like to start by watching this short animation, which explains what’s happening.

GMPe for historical transfers explained

If you have received a TotalEnergies-branded information pack containing a letter from Aon to your home address, please read on. We understand that receiving a message like this might make you feel uncertain, especially when it involves sharing your personal details. Please rest assured that this is genuine, and we are here to support you every step of the way.

About the Plan

The TotalEnergies UK Pension Plan provides benefits for employees of TotalEnergies and its subsidiaries. It has a Defined Contribution Section, currently open to new members, and a Defined Benefit Section that closed to new joiners, between 2002 - 2007 and then all Sections closed to future build-up of benefits on 31 December 2021. The Plan was contracted out of the State Earnings-Related Pension Scheme between 1978 and 1997, meaning that members during that time built up a GMP as part of their benefits.

The Trustee of the Plan is TotalEnergies Pension Trustee UK Limited, a Trustee Company with a Board of Directors, some of whom are appointed by TotalEnergies as the sponsoring employer, and others appointed by the members.

This exercise is only looking at anyone who took a transfer out of the Plan since 2002.

Due to company changes over time, the original pension scheme you were a member of may have had a different name. The previous names of this Plan have been:

- TotalFinaElf UK Pension Plan

- Total UK Pension Plan

What you need to do

Inside the folder that was sent to your home address, you will find a letter from Aon (on behalf of the Trustee) with instructions on how to request your one-off top-up payment. Please review it carefully and provide your current personal details to start the process.

If you have any questions, please contact Aon directly using the details provided in their letter or at the bottom of this page.

Who are Aon?

The Trustee has appointed Aon, the Plan Actuary, to manage the process of contacting former Plan members about their top-up payments.

Aon is an accredited member of the Pensions Administration Standards Association and brings a wealth of expertise and reliability to this exercise.

Is this a genuine offer?

We would like to reassure you that this is completely genuine. You can read relevant guidance on the HM Revenue and Customs website, confirming the exercise’s authenticity.

What you need to do next

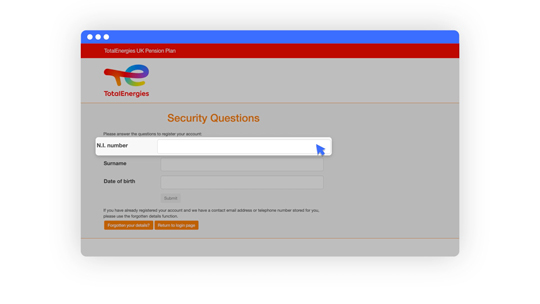

To ensure a smooth and efficient process, you will need to follow these steps:

Step 1: Confirm the details that Aon require.

There are three ways to do this:

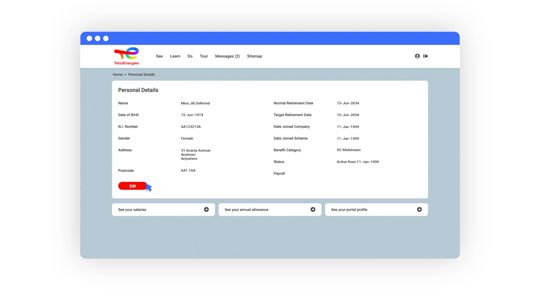

- Online: visit the Validation portal to securely submit your information.

- Call: 0330 818 4316 to speak with an Aon representative who can assist you.

- Paper form: Complete and return the paper form to Aon, PO Box 196, Huddersfield, HD8 1EG. This is included in your pack.

Once you have successfully completed this step, Aon will send you another information pack detailing your one-off top-up payment and your options for how to receive it.

Step 2: Review your one-off top-up payment options and confirm your preferred payment method.

Depending on the size of your payment and preferences, you will need to choose how you receive your one-off top-up payment. Options may include a direct payment to your bank account or a transfer to another pension arrangement.

Aon will then confirm when your one-off top-up payment will be made and ensure it is processed according to your instructions.

Tax implications

There may be tax implications as a result of this review of your GMP benefits.

Reviewing your GMP benefits could push your overall annual income into a higher tax bracket. This could be because of the one-off payment you are receiving due to historic payments being too low.

It is possible to obtain a breakdown of historic payments so HM Revenue and Customs can spread these across the relevant tax years and allow any tax liability to be recalculated. If you think you may need this breakdown, you should contact the Plan Administrator.

Contact information

Get in touch with Aon for help with your one-off top-up payment

0330 818 4316 – open Monday to Friday from 9am to 5pm, excluding bank holidays.

Aon

PO Box 196

Huddersfield

HD8 1EG

Make sure you have your top-up reference to hand if you are contacting Aon. It can be found at the top of the first page of your letter.

If you would like to get independent financial advice

MoneyHelper’s Retirement Adviser Directory can help you find a regulated financial adviser in your area.

Disclaimer

This webpage and the information contained herein are provided as a summary of the law and guidance applicable at the time of issue. It is intended for general informational purposes only and should not be construed as legal advice or relied upon in any specific legal situation. Please be aware that benefits and entitlements are ultimately governed by the provisions of the Plan’s trust deed and rules, which are subject to amendments and modifications from time to time and the governing legislation.