Understanding the Annual Allowance (AA) charge

The AA is the amount of pension benefits you can build up over the course of each tax year from all of your pension arrangements before you must pay a tax charge.

For the 2025/26 tax year, the standard AA is £60,000.

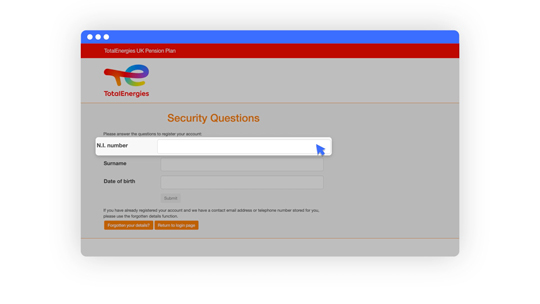

Your Pension Savings Statement

This shows how much AA you have used during the previous ‘pension input period’ (the tax year ending 5 April 2025) and any unused AA from the previous three tax years. You can ‘carry forward’ this unused AA to offset any excess savings in the current tax year.

If you have received a Pension Savings Statement from Gallagher, the Plan Administrator, there is a helpful guide called ‘Tax and your pension’ to explain what this means for you.

Paying an AA tax charge

If your total pension savings exceed the AA after applying carry forward, the excess is added to your taxable income, and tax is charged based on your applicable Income Tax band.

Unless you use Scheme Pays, to pay this charge you must complete a Self-Assessment Tax Return by registering with HM Revenue and Customs. There are two deadlines to do this by for the 2024/25 tax year:

- 31 October 2025 for paper submissions.

- 31 January 2026 for online submissions.

Scheme Pays

Instead of completing a Self-Assessment Tax Return, you can use Scheme Pays to request that the Trustee pays the tax charge on your behalf by reducing your pension benefits. There are two options available:

- Mandatory Scheme Pays (if you meet certain criteria, the Plan must pay this charge for you if you tell them to). The deadline for this is 30 November 2025.

- Voluntary Scheme Pays (in some cases the Plan may choose to pay the charge for you, even if they do not have to). The deadline for this is 31 July 2026.

You can find a Mandatory Scheme Pays Election form and/or a Voluntary Scheme Pays Election form in the Library.

If you have any questions, please contact Gallagher, the Plan Administrator.