Lifetime Allowance (LTA) pension protection – last chance to apply

Even though the LTA has been removed, it might still be possible for you to apply for certain types of protection before 5 April 2025, to get a higher tax-free lump sum than the current limit of £268,275. The LTA was the maximum amount you could build up in pension benefits over your lifetime before paying a tax charge. The value of the LTA has reduced at various points between 2006 and 2024, and anyone who had already built up benefits greater than the LTA was eligible to apply to protect their current value.

Two forms of protection are still available to apply for, if you meet the criteria.

- Fixed Protection 2016 sets the LTA at £1.25 million. You can apply if:

- you or your employer have not contributed to your pension savings since 5 April 2016

- you opted out of any workplace pension scheme by 5 April 2016

- Individual Protection 2016 allows people who had already accumulated more than £1 million at 5 April 2016 to continue pension saving with a maximum LTA of £1.25 million.

International enhancements

If you have worked overseas whilst accruing benefits under the Plan, you may be able to apply for an international enhancement, but you must do so by 5 April 2025.

The deadline for an application is the earlier of:

- 31 January following the end of the tax year, 5 years after the end of the tax year in which the accrual period ends; or.

- 5 April 2025

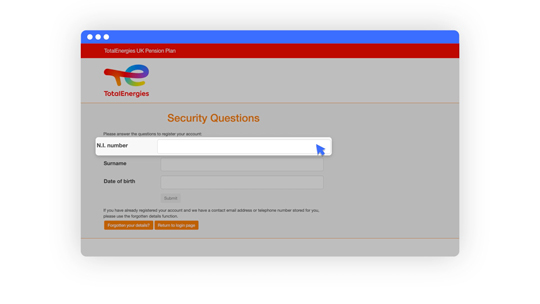

You can apply for either protection by visiting the HM Revenue and Customs (HMRC) website and using their online application process. The deadline to apply for Fixed Protection 2016 and Individual Protection 2016 is 5 April 2025.

Due to the complexity of pension tax planning and HMRC’s protection rules, you may want to consider taking independent financial advice.